Risk Management

Risk Management

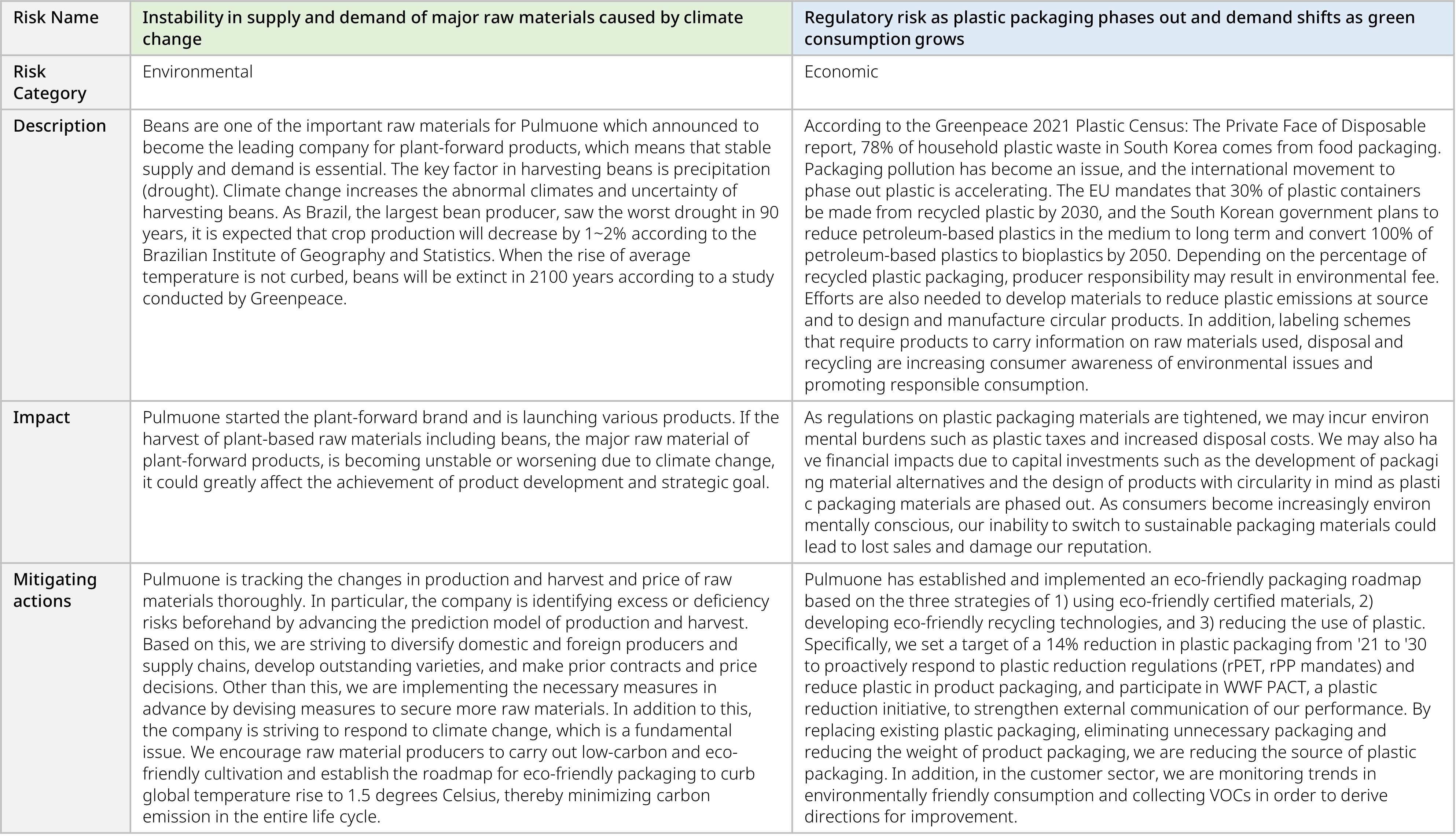

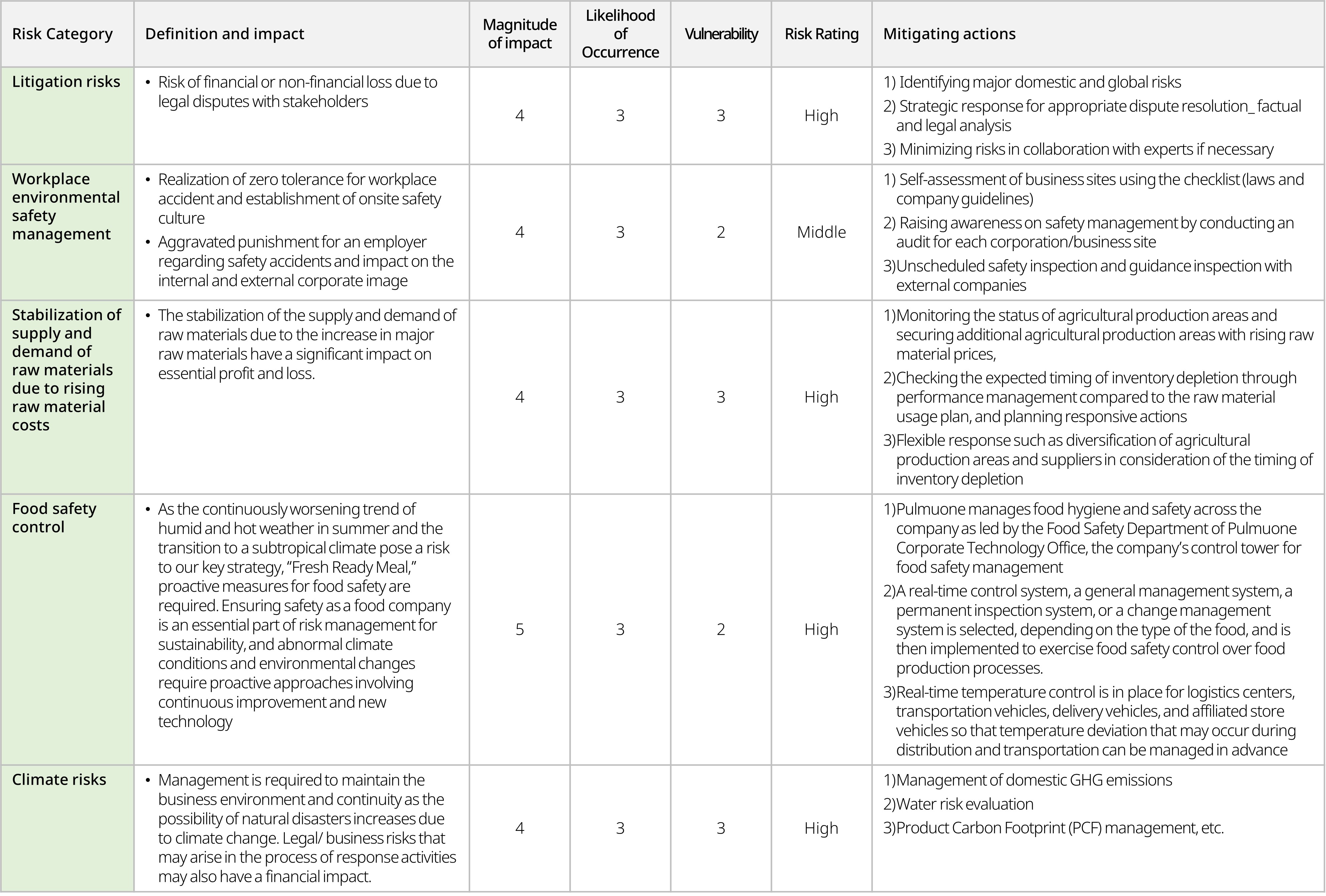

Pulmuone operates an enterprise-wide integrated risk management system that extends from financial to non-financial areas to prevent risk factors that threaten continuous management. In accordance with the Enterprise Risk Management Regulations, we conduct a periodic evaluation of the company-wide (all affiliates) risk pool once a year to reassess and update the risk rating (low, middle, and high) for each risk. In addition, apart from the periodic evaluation, the risk pool of affiliates is reviewed annually, and after three years, the risk pool of affiliates is renewed from a zero base every fourth year. The results of the company-wide risk assessment and risk renewal for each affiliate are reported to the Risk Management Committee. Risks are evaluated for their degree of impact, likelihood of occurrence, and level of control, and the final risk rating is categorized into low, medium, and high based on the analysis results (risk impact, cause, and level of control of the cause). In order to identify risks without duplication or omission and improve the efficiency of post-management, we categorize them into governance risks (corporate governance, ethics), strategic risks (corporate social responsibility, environment, management, business strategy), operational risks (food safety, ESH, sales and marketing, product development, supply chain), and infrastructure risks (legal, compliance, finance, HR, public relations, IT). Identified risks are categorized into contingency accounting, scenario response, indicator management, and control enhancement types based on the uncertainty of risk development and controllability of risks to establish optimal response measures.

Among the risks in the risk pool, risks with a high rating are selected as risks to be managed in the current year, and monitoring methods and cycles are set, and monitoring is conducted according to the set cycle. Affiliates summarize the monitoring and major issues of related high risk and report them to the risk management committee of each affiliate and share them with the company-wide RM manager. The company-wide RM manager gathers the reports from the risk management committees of each affiliate, summarizes key issues, and reports to the company-wide risk management committee, the highest decision-making body for risk management. The Internal Audit Organization provides reasonable assurance of enterprise-wide risk management by auditing the control and operation of risks annually (conducted two internal audits). We analyze various types of risks other than market or price risks, and conduct sensitivity and stress testing. For example, the WWF's Water Risk Filter tool is used to assess water stress for facilities, and the WRI's Aqueduct tool is used to assess providing safe, managed WASH (Water, Sanitation, and Hygiene) services to all employees.

[Risk Management Procss]

[Major Risks]

(5-High, 1-Low)

■Sensitivity Analysis and Stress testing

1. Financial Risks

1) Foreign exchange risk

Pulmuone’s foreign exchange risk arises primarily from fluctuations in the exchange rates of recognized assets and liabilities. Pulmuone manages foreign exchange risk through currency forward transactions, etc. when it is deemed necessary to hedge against foreign exchange risk in the business transactions. Foreign exchange risk arises when future transactions and recognized assets and liabilities are denominated in a currency other than the functional currency.

2) Interest rate risk

Interest rate risk arises from borrowings with floating interest rate terms and debentures issued with floating interest rate terms. To minimize the risk of interest rate fluctuations, we conducts various methods of analysis, including sensitivity analysis and stress tests, and considers various methods such as refinancing, renewal of existing borrowings, alternative financing and hedging to make decisions on the most favorable financing arrangements. As of December 31, 2013, a 1% increase (decrease) in interest rates on borrowings with variable interest rate terms, with all other variables held constant, would result in a decrease (increase) of 32,269 KRW million in profit before income taxes for the year.

3) Liquidity risk

Prudent liquidity risk management includes the maintenance of sufficient cash, the availability of funds from appropriately committed lines of credit and the ability to settle market positions.

*Refer to the business report for detailed financial risk analysis.

2. Non-financial Risks

1) Stabilization of raw material supply and demand (representative raw material: soybean)

We analyze the expected timing of inventory depletion (sensitivity test) of major raw materials by analyzing the trend of usage/inventory of major stockpiled raw materials to determine supply and demand risks and whether to expand/reduce supply plans in advance. We check the level of crisis response by comprehensively analyzing risks based on the purchase plan, usage, and expected time of inventory depletion.

2) Water Risks

Based on ISO 14001 environmental management system and the Enterprise Risk Management (ERM) Principles & Guidelines, the relevant departments continuously monitor environmental risks, including water-related risks. Our company manages all potential risks across its business operations using the Pulmuone Risk Map. To assess environmental legal risks for manufacturing and logistics facilities, an ESH Audit tool has been developed based on environmental and safety-related regulations (such as the Water Environment Conservation Act, Groundwater Act, Sewerage Act, etc.), and audits are conducted accordingly. Any non-compliance issues identified during the audit are monitored and addressed. The water stress assessment for the facilities is performed using the WWF Water Risk Filter tool, and the provision of safety managed WASH (Water, Sanitation, and Hygiene) services for all employees is evaluated using the WRI Aqueduct tool. Based on the diagnostic results, significant changes are taken into consideration to establish and review water resource management goals. Pulmuone conducts water stress assessments for its supply chain, including the origin of soybeans (raw materials), using the WWF Water Risk Filter tool. Additionally, to assess whether safety managed WASH services can be provided to employees within the supply chain, Pulmuone utilizes the WRI Aqueduct tool to evaluate drinking water risks. Through these assessments, the company can gain insights into the highest-risk raw materials or suppliers and their respective locations, enabling them to better understand potential risks in their supply chain related to water availability and drinking water safety.

3) Climate Risks

In Pulmuone, climate change-related risks include identifying and assessing climate change risks and opportunity factors that have potential impacts on business. According to the Risk Management Manual, the risk falls into three rating levels in each field of finance, reputation, safety, and operation.

Risk response : 1. Minor level: Crisis that can be responded at the headquarter level and subject to fines, 2. Serious level: Requires a response from the business division, 3. Critical level: Requires a company-wide response

A rating is assigned according to the extent to which it causes financial losses. The reputation risk increases due to some local media coverage, local reputation damage, long-term exposure to major media, and the resulting increased public anxiety. In safety risks, a rating is identified to be assigned to minor damage, serious injury or death of executives and employees, vendors, and consumers. Operational risks can be identified in the order of regulatory violations, short-term business suspension, recalls and sanctions by regulatory authorities, loss of production and distribution capacity, and long-term business suspension. We also use climate change scenario analysis to analyze risks and opportunities and assess quantitative and qualitative impacts on the company. The company-wide Risk Management Committee checks whether additional responses are needed and discusses directions for improvement. To see if the risk response is appropriate, a constant monitoring system is in operation.

[Emerging Risk]