Financial Risks and Opportunities Related to Climate Change

Climate Change Scenario Analysis & Identifying Financial Risks and Opportunities

To guide our strategic decisions toward reaching the net zero target by 2050, we carried out a climate change scenario analysis in 2023. This analysis looked ahead to the years 2025, 2030, 2040, and 2050, covering both our entire organization and the main areas where we source raw materials.

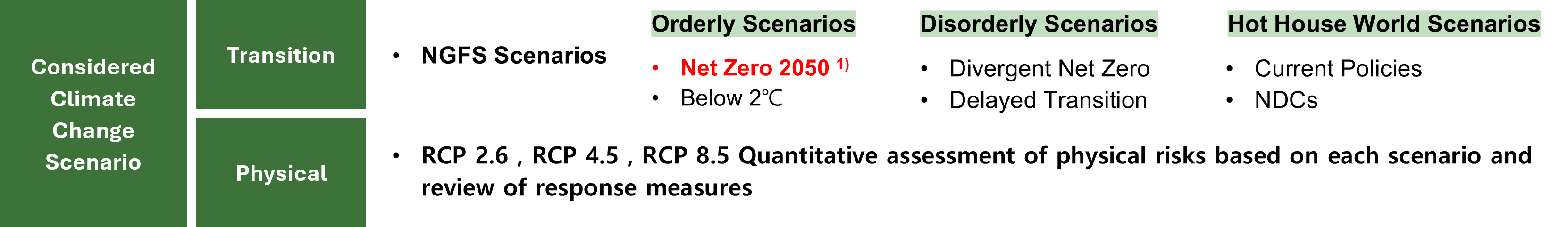

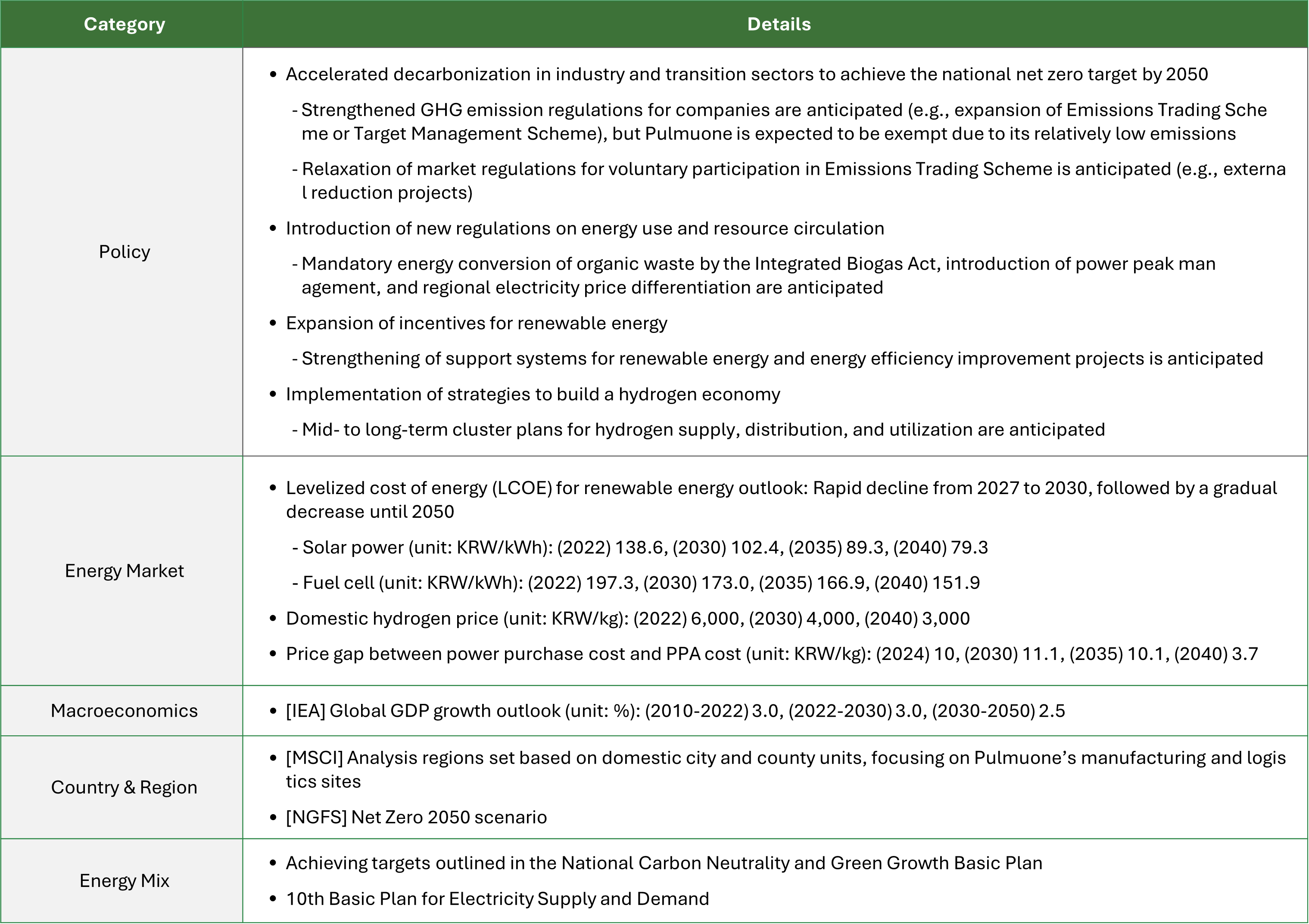

The key scenarios used in the analysis are the transition scenarios (1.5°C and 3°C pathways) proposed by the Network for Greening the Financial System (NGFS), and the Representative Concentration Pathways (RCP 2.6, RPC 4.5, RPC 8.5) scenarios from the Intergovernmental Panel on Climate Change (IPCC). Among the six NGFS scenarios, we primarily focused on the Orderly Net Zero 20501) scenario, as it closely aligns with national policy directions. The RCP scenarios were applied to quantitatively assess physical risks, based on the correlation between GHG concentrations and temperature increases.

When it comes to scenario analysis, the assumptions used can be updated as research and projections develop over time. Pulmuone monitors the latest research efforts and insights from NGFS, IPCC, IEA, and other global organizations while expanding and improving the scope of scenario analysis to come up with more effective responsive strategies.

1) According to the NGFS analysis, the estimated physical loss costs under the 1.5°C and 3°C pathways were approximately KRW 48.2 billion and KRW 74.6 billion, respectively.

[Key Assumptions of Scenario Analysis]

Identifying Climate Change-Related Financial Risks and Opportunities

Pulmuone identifies climate-related risks and opportunities that are reasonably expected to impact our business outlook, managing a total of 139 items as a long list. Every year, we update this list based on the implementation guidelines of IFRS S2, SASB indicators, and the MSCI Climate Value at Risk (VaR) tool. We also incorporate global trends, industry insights, and expert opinions both within and outside our company. From this long list, key risks are prioritized and consolidated into a short list for focused management.

Climate materiality assessments classify the scope of impact for key risks into upstream, in-house operations, and downstream. These assessments are conducted from short-, mid-, and long-term perspectives, considering the likelihood of occurrence, financial impact, and social and environmental impact. We apply the principle of double materiality, and the assessment is carried out every two years.

Impact of Climate-Related Risks and Opportunities on Our Business Model and Value Chain

Pulmuone is a comprehensive food company with revenue generated across multiple sectors of the food industry. The main businesses of our consolidated subsidiaries focus on domestic food manufacturing, distribution, and related services. Our major revenue streams come from the production and sale of home meal replacements (HMRs), plant-based protein products, eco-friendly foods, and fresh food items, with the majority of manufacturing facilities and logistics infrastructure located in Korea. We source key raw materials globally, including from the United States, China, Canada, and Türkiye.

Considering Pulmuone’s business structure and value chain, climate change affects both the company and its entire value chain through uncertainties in raw material supply sources and timing, rising energy costs, and changes in climate-related regulations. These impacts are expected to intensify in the future.

■ Financial Impact of Risks from Regulatory Changes: Strengthening of Emission Regulations

The Republic of Korea, where Pulmuone is located, implements the Target Management System and Emissions Trading System. The Target Management System is a system that sets reduction targets and verifies and manages implementation performance for business sites that emit 50,000 tons or more of greenhouse gases on a company basis or 15,000 tons or more on a business site basis. The Emissions Trading System targets companies with an average annual greenhouse gas emission of 125,000 tons or more over the three years from four years prior to the planning period, or companies that own business sites with 25,000 tons or more, and also includes voluntarily participating business sites.

All business sites, including those of our consolidated subsidiaries, emit less than 15,000 tons of GHG annually, placing them outside the scope of the Emissions Trading Scheme and the Target Management Scheme. However, PPEC Eumseong Fresh Noodle, a subsidiary of Pulmuone Foods, may fall under the Target Management Scheme in the short term due to the expansion of its third plant and the resulting increase in production capacity.

Accordingly, Pulmuone estimated the projected emissions (BAU) until 2050 for all business sites excluding those located in highway rest areas, and selected business sites with high probability of being included in the Target Management System and Emissions Trading System. Allowances were calculated reflecting the national industrial sector greenhouse gas reduction targets, with paid allowances assumed to increase from the current 10% by planning period to reach 70% by 2050. In case the company fails to implement greenhouse gas reduction, the "additional amount of emission allowances to be purchased" was calculated as the remainder after excluding free allowances provided by the government from total emissions (including paid allowance amounts).

Emission allowance purchase costs were considered under four scenarios: 1) Scenario where K-ETS prices are maintained, 2) NGFS NDCs scenario, 3) NGFS Below 2°C scenario, and 4) NGFS NetZero 2050. The amounts were estimated by multiplying these prices by the "additional amount of emission allowances to be purchased." As a result of calculations, the financial risk from regulatory changes was estimated to increase up to KRW 209,042 million.

Taking action:

Pulmuone has established a Transition Plan to respond not only to risks from regulatory changes but also to overall risks from climate change, with targets of 20% reduction in Scope 1 and 2 emissions by 2030 compared to 2022, achieving Net Zero emissions and RE100 by 2045, and realizing company-wide Net Zero including Scope 1, 2, and 3 by 2050. Primary reduction measures being considered include converting power sources to renewable energy, as well as converting LNG and LPG boiler fuels, which account for the majority of Scope 1 emissions, to low-carbon fuels. The expected response costs are estimated to require a total investment of KRW 260,683 million: short-term ('24-'27) KRW 5,232 million, medium-term ('28-'35) KRW 46,828 million, and long-term ('36-'50) KRW 208,611 million. This represents the estimated Capex and Opex amounts from 2024 to 2050 for investments in internal facility improvements (high-efficiency equipment replacement, etc.), fuel cells, and renewable energy procurement (solar power, PPA, etc.).

■ Financial Impact of Physical Risks: Increased Supply Chain Instability Due to Increase in Heat Wave and Heavy Rain Days

Climate change-induced abnormal temperatures and precipitation changes are leading to decreased productivity and supply stability of agricultural, livestock, and marine products. Pulmuone's core raw materials such as soybeans, napa cabbage, and marine products are sensitive to climate condition changes, resulting in risks such as delayed cultivation timing, reduced harvest yields, and increased raw material unit costs becoming reality. Analysis shows that actual damage of approximately KRW 40 million annually has occurred in some product categories, which can lead to inventory asset impairment and sales disruptions.

In particular, as a result of conducting a CRAS assessment on Hagui Agricultural Cooperative, which is Pulmuone's soybean supplier, the number of heat wave days (daily maximum temperature of 33°C or higher) in Jeju City, Jeju Special Self-Governing Province, is predicted to increase approximately 12.5 times from the current climate baseline (2001-2010) of 4.9 days to the 2100s. The effective accumulated temperature¹⁾, which quantifies the cumulative heat (temperature) required for crop growth and is an important factor for soybean cultivation, is projected to exceed 3,000°C after the 2070s under the RCP 8.5 scenario, raising concerns about growth inhibition and production decrease. Meanwhile, the number of heavy rain days shows a slight decrease under RCP 2.6 and 4.5 scenarios, but tends to increase under the RCP 8.5 scenario. Both RCP 4.5 and 8.5 scenarios project a sharp increase in maximum precipitation in the late 21st century (2071-2100). As a result, the frequency of heavy rain occurrence and the extremity of its intensity are also expected to increase together.

1) Accumulated thermal units (temperature) required for crop growth, expressed as a numerical value.

Accordingly, to estimate the medium to long-term financial impact on Pulmuone, analysis was conducted based on RCP 4.5 and RCP 8.5 scenarios using the CRAS system. (Climate Change Risk Assessment System) While the analysis period spans from 2011 to 2100, data from 2023 to 2050 was intensively analyzed to align with Pulmuone's management time horizon (short-term, medium-term, long-term). By applying an analytical methodology that reflects changes in corporate components according to economic scenarios within the CRAS system based on financial statements and income statements from the past three years, it is estimated that risks from heat waves during 2023-2050 will result in revenue losses of minimum KRW 157,254,052 to maximum KRW 452,323,847 for Hagui Agricultural Cooperative, our supplier.

Taking action:

Pulmuone is pursuing the acquisition of various trading partners to secure a sustainable supply chain and ensure stable supply and demand of raw soybeans, and is conducting on-site inspections for new production area development and audits of suppliers. Based on supply chain ESG management policies, thorough quality verification procedures are performed during the partner company selection stage, including germination tests, pesticide residue tests, and GMO tests. When partner companies renew contracts annually or conclude new contracts, regular performance evaluations are conducted to support continuous maintenance of quality standards from the initial selection stage.

As a result of estimating response costs, management costs including business trip expenses for Pulmuone personnel, germination evaluation costs, and external agency testing costs are estimated to total KRW 107,600,000 per production area.

■ Financial Opportunities from Climate Change: Transition to Sustainable Products and Services

According to the Food and Agriculture Organization (FAO) of the United Nations, GHG emissions from the livestock sector account for approximately 14.5% of global GHG emissions, with 65% coming from methane gas released during the digestive process of cattle. In 2008, the Netherlands Environmental Assessment Agency (PBL) reported that if the global population were to switch to a plant-based diet, approximately 80% of existing pastureland could be restored to forests and grasslands. Although a complete vegetarian transition for all humanity is practically difficult, simply expanding plant-based diet consumption to the level recommended by the World Health Organization (WHO) can reduce greenhouse gas emissions in the food sector by approximately 30%, in addition to reducing greenhouse gas emissions from the livestock sector.

We have set a goal to increase the share of sustainable food sales to 65% of our total revenue by 2027. 2) Thanks to the growing recognition and sales of our flagship sustainable food brand, “Jigusikdan,” sustainable foods already accounted for 56% of our total revenue in 2024. In the same year, we successfully launched “Garden Me,” a new plant-based health food brand, further expanding our sustainable food portfolio. Additionally, Pulmuone recorded approximately KRW 1.3 trillion in revenue from sustainable food sectors including Plant-Based Foods and Plant-Forward FRM (Fresh Ready Meals) during 2024.

According to the 'Status and Growth Industrialization Strategy Report of the Plant-Based Food Industry' published by the Korea Rural Economic Institute in February 2025, the global plant-based market is projected to grow by more than 13% annually until 2032. Accordingly, Pulmuone's planetary diet business opportunities are expected to continue for the next 10 years.

Opportunity Development Costs :

Pulmuone is expanding sustainable food through brand strategies tailored to the characteristics of each country, expanding markets centered on the 'Pulmuone Planetary Diet' brand domestically, 'Plantspired' in the United States, and 'Toffu Protein' in Japan. Accordingly, by establishing regional localization strategies and implementing active marketing strategies, the company achieved the number one market share in the US B2C tofu market. Based on this, the opportunity development costs were estimated at KRW 9,063 million, which represents the marketing costs for 'Planetary Diet' during 2024.