Pulmuone Tax Policy

Pulmuone Tax Policy

Pulmuone abides by the country's tax laws and fulfills its obligation to pay taxes imposed on its profits. To this end, we established the tax policy and regularly provide the relevant education program to the employees in charge of accounting and tax affairs. When necessary, we receive consultation from external experts, including law, accounting, and tax firms.

Basic Principle

-. Pulmuone strives to comply with domestic and foreign tax laws and regulations and files a tax report and pays taxes in a transparent and fair manner.

-. In accordance with its TISO management principles, Pulmuone responds to requests from the tax authorities sincerely with mutual respect, and fulfills its obligation to cooperate in tax matters without concealment, distortion, or exaggeration.

-. Pulmuone will actively respond to changes in tax laws in each region and swiftly apply these changes in its business.

Risk Management

-. Pulmuone will minimize unexpected tax risks across all business operations.

-. Pulmuone will constantly make company-wide efforts to build the external compliance inspection system, provide internal education, and set consistent business management standards. We will consult and cooperate with external experts to identify tax risks and update our tax policy.

-. Pulmuone will meet all tax reporting and payment deadlines, and keep the evidence and reasons for decisions made for business contracts in the form of documents.

Eradication of Tax Avoidance

-. Pulmuone will maintain a normal investment and trade structure that conforms to the intent of the tax law in regard to transactions with third parties and/or special affiliated parties.

-. Pulmuone will maintain fair prices in trade with third parties and/or special affiliated parties in accordance with the relevant regulations in Korea, while following the OECD guidelines and BEPS standards for international trades at normal prices.

-. Pulmuone will not use tax havens (low tax jurisdictions) and tax structures without commercial substance to avoid tax.

-. Pulmuone will not to transfer value created to low tax jurisdictions.

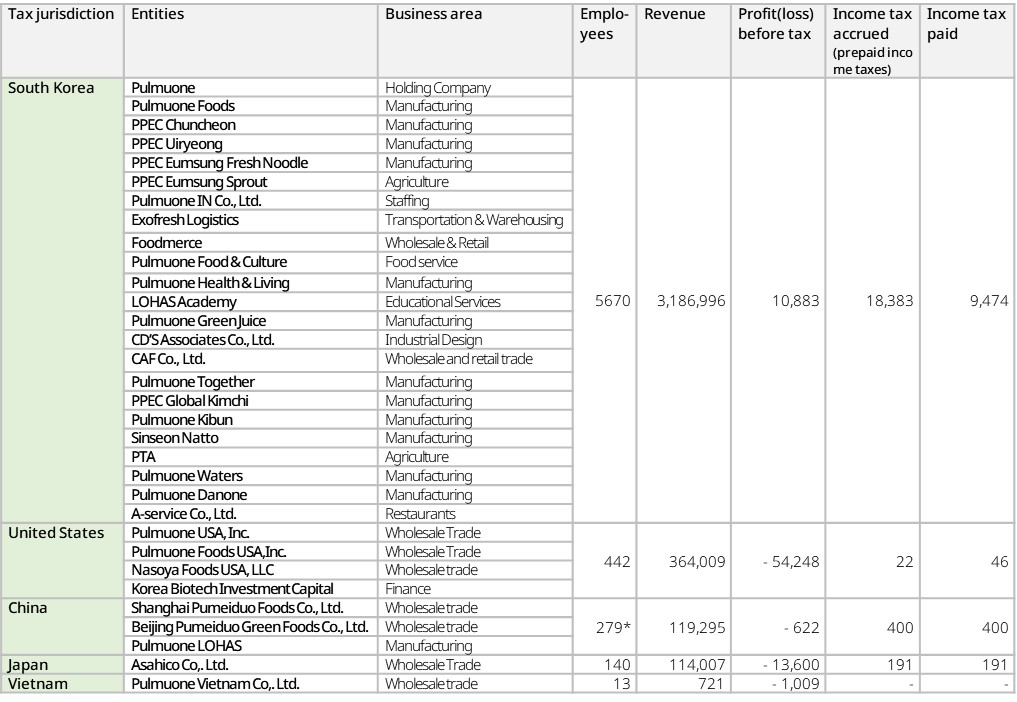

-. Overseas subsidiaries of Pulmuone are located in the United States, China, and Japan, Vietnam as of 2022 and Pulmuone abides by the tax act, principles, and standards adopted in each country.

Transfer Price Policy

-. The transfer price refers to the price applied to an international transaction of raw materials, products, and services with overseas subsidiaries or affiliates. Global companies often adjust the transfer price to alleviate their tax burden, which has become an issue in the industrial sector. Upholding its principles of transparent and sincere tax payment, Pulmuone prohibits transfer pricing in favor of the company under any circumstances. We set the transfer price strictly in accordance with the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations and local tax laws in each country. Therefore, we pay tax on our business profit under the national tax law.

[2022 Pulmuone Company-wide Tax Payment]

*The number of Employees in China only includes Shanghai Pumeiduo Foods Co., Ltd. and Beijing Pumeiduo Green Foods Co., Ltd.